Online – Worldwide eCommerce sales account for over US$1.3 trillion dollars. Are you profiting? Tap into a world of opportunity and reach new markets with GlobalOnePay. Plus you’ll be able to enter new markets and grow your business without significant upfront capital costs. All it takes is the GlobalOnePay payment processing platform to increase online revenue and reach a global clientele.

Omni Channel Processing

Smart solutions for an omni-channel world

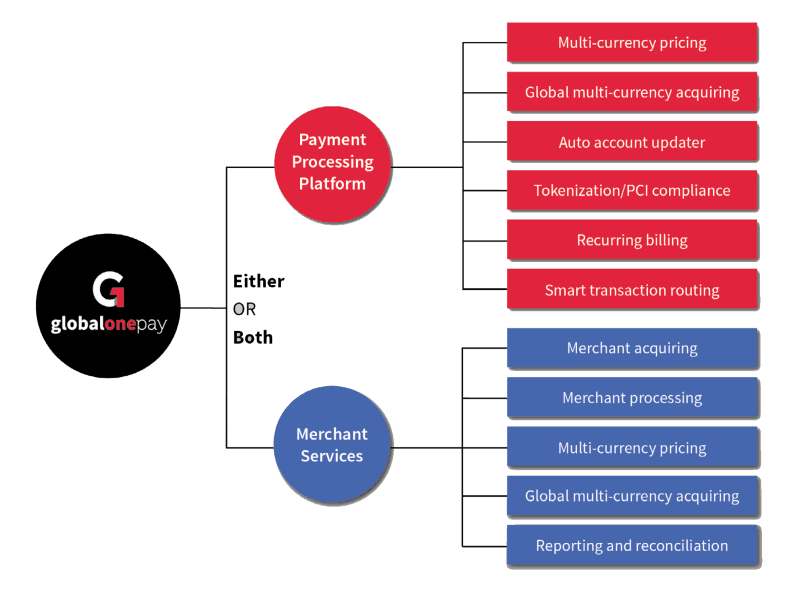

GlobalOnePay combines a global payment processing platform with a wide range of local merchant services. You’ll have the unique flexibility to build the solution that fits your business best, minimizing cost and maximizing profit – that’s the value of GlobalOnePay.

Powerful cloud-based payment processing platform

The GlobalOnePay payment processing platform combines a host of omni-channel solutions to help your business increase revenue and efficiencies while easily extending reach to a global clientele. A single point of integration gives you access to 80+ processing currencies, connectivity into 130+ networks and banks along with the ability to accept all major forms of electronic payment across online, in-store and mobile channels. Best of all, no matter how your customers want to buy, you can deliver a consistent unified purchase experience. All it takes is GlobalOnePay.

Flexible merchant services

Even if you are not leveraging GlobalOnePay for payment processing, you can utilize our cost-effective merchant services if you open a merchant account with us. Our merchant processing solutions provide the flexibility to have one or multiple merchant accounts covering international markets. We also offer next day funding to improve cash flow as well as gift card and loyalty programs to help drive sales.

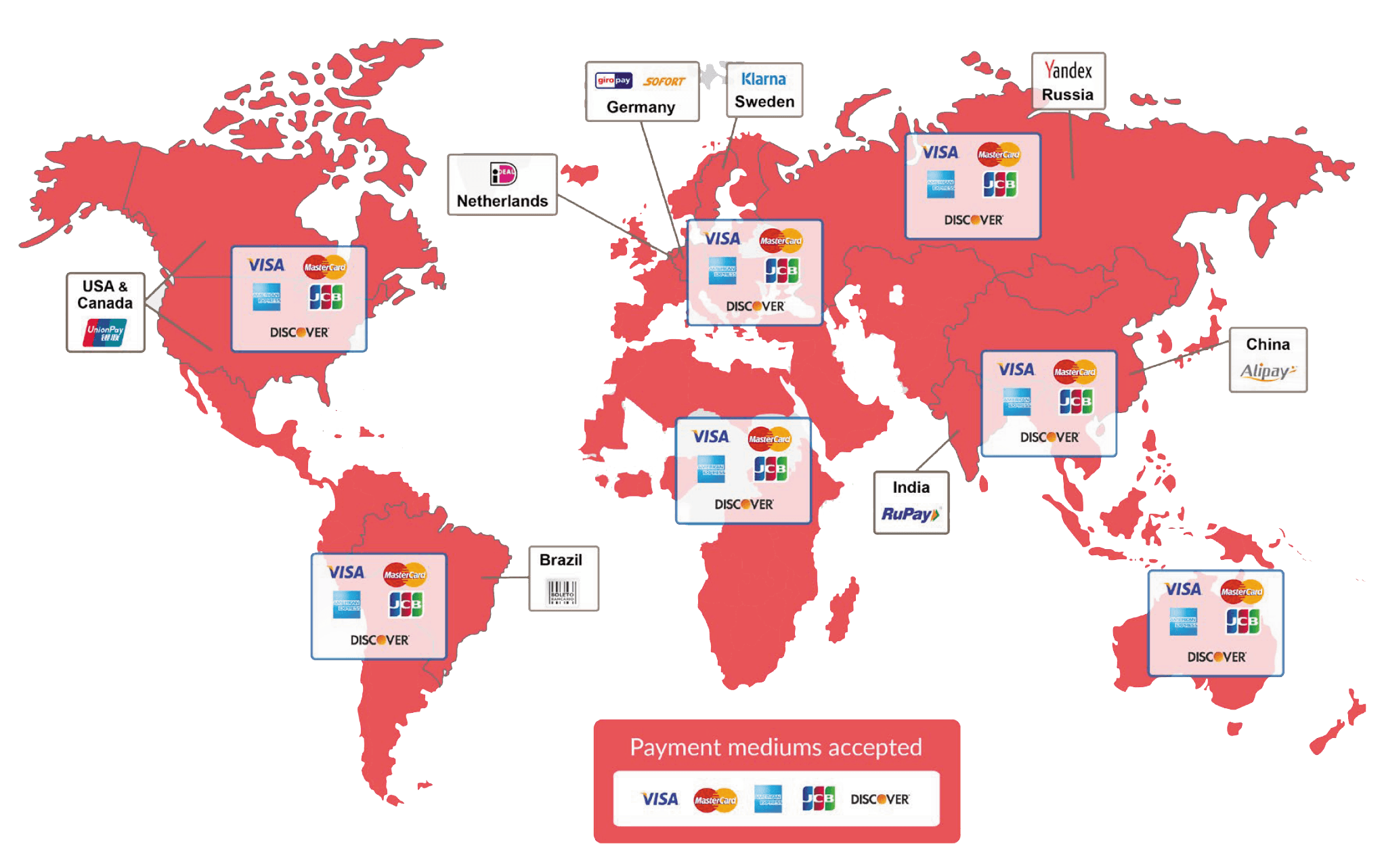

Accept more payment types worldwide

Available as a standalone option or bundled with our value-added merchant services, our modular, scalable, cloud-based payment processing platform provides access to a world of business opportunities.

With 130+ processor certifications, GlobalOnePay makes it possible for you to accept:

- Credit cards: Visa, MasterCard, American Express, Discover, JCB, China UnionPay

- Alternative payment

- ACH

- Contactless payment

- Direct debit

- Apple Pay

- And more

In-store point of sale – With GlobalOnePay, you can enjoy seamless integration with the POS system of your choice with no added gateway or middleware. Regardless of the payment environment, industry or sales channel, GlobalOnePay in-store payment solutions enable easier checkout and faster payment processing for higher levels of customer satisfaction. And as new payment types and features become available, they can be accommodated via remote software updates with no need for hardware upgrades or on-site visits.

Mobile – Mobile commerce (mCommerce) purchases and in-app payments made on mobile devices are rapidly becoming just as popular, if not more so, than traditional computer-based eCommerce transactions. In addition, Apple Pay, MasterCard PayPass, Visa payWave, Android Pay and other mobile wallet apps are revolutionizing the way consumers purchase goods and services as they wave their mobile devices across mobile point of sale (mPOS) terminals in brick and mortar stores. The mobile payment trend is exploding and GlobalOnePay can help you capitalize on it.

Industry-leading features

The GlobalOnePay payment processing platform has been developed from the ground up to provide the cutting edge technologies any business needs to thrive. In addition to “like for like” currency acceptance, which enables businesses to bill customers and receive payment in 12 major currencies, GlobalOnePay also provides the ability to:

Access 130 global payment processors

Sell in multiple currencies and accept a wide range of local and alternative currencies

Automate client account updates and recurring billing

Lower PCI liability risk with tokenization to avoid storing sensitive card information

Minimize losses due to fraud with best-in-class fraud modules and access to a global database of fraudulent credit cards

Access detailed payment and account data as well as advanced analytics through an online portal

Easy integration

An XML gateway provides eCommerce businesses with direct integration via an application program interface (API) or they can minimize development time and cost by using hosted payment pages. Shopping cart plug-ins for many independent vendors are also available. For mobile payment processing (mPOS or in-app), a dedicated software development kit (SDK) facilitates that integration, whether you are running on iOS or Android. We also provide a point-of-sale (POS) software development kit for integrating in-store POS payment processing with a broad range of terminals. Using GlobalOnePay’s live chat feature, you can get answers or issues resolved directly within the portal from our client card and tech support teams. We’re here to help.\

Merchant services to support your growth

Let GlobalOnePay help you with your global acquiring needs with our turnkey merchant services. By combining our technology and our acquiring solution into a single agreement, GlobalOnePay helps you seamlessly expand around the world, reduce cost and simplify implementation.

Merchant acquiring

A rich partner bank network and extensive acquiring capabilities means we can meet your global acquiring needs regardless of country, vertical, market, risk and/or currency.

Merchant processing

GlobalOnePay’s extensive risk management and underwriting experience combined with our vast acquiring network makes us an ideal acquiring solution. Plus our acquiring and merchant processing solutions provide the flexibility to have one or multiple merchant accounts covering international markets.

Multi-currency pricing

When international shoppers visit your site, they see prices in their native currency. Studies have shown that MCP can increase sales conversion by up to 12% because of the added convenience.

Global multi-currency acquiring

With the ability to have local acquiring in your region as well as internationally, you’ll be able to capture and settle funds in numerous currencies and alternative payments without having to change your existing business structure or set up new, foreign bank accounts.

Reporting and reconciliation

GlobalOnePay360 is an online reporting tool that enables you to access your payment information and manage your account data anytime, anywhere. View statements and extract detailed reports in CSV or PDF format. Check daily, monthly and annual sales data for powerful business intelligence.

Start growing your business today

It’s easy to begin using the GlobalOnePay payment-processing platform within hours. We assist every step of the way. To learn more or get started, please contact us.